Today, there are many freight forwarding companies, which creates healthy competition in the market in the field of international transport services. However, in pursuit of the transportation speed or for any innovation in this area, many companies often forget that the Customer must know and understand simple things:

how much is the cost of delivery and additional services;

the condition of the cargo;

according to which scheme it moves;

for what exactly the customer must pay.

Sometimes there are such situations that the freight forwarder has no control over the situation and finds it difficult to give information about the location of the cargo, which entails extra costs for the demurrage and storage at the container terminal and penalties for excessive use of container equipment.

Professional freight forwarders know how important the cargo is for the customer. They understand that every qualitatively delivered cargo is the key to successful development of the Customer’s business.

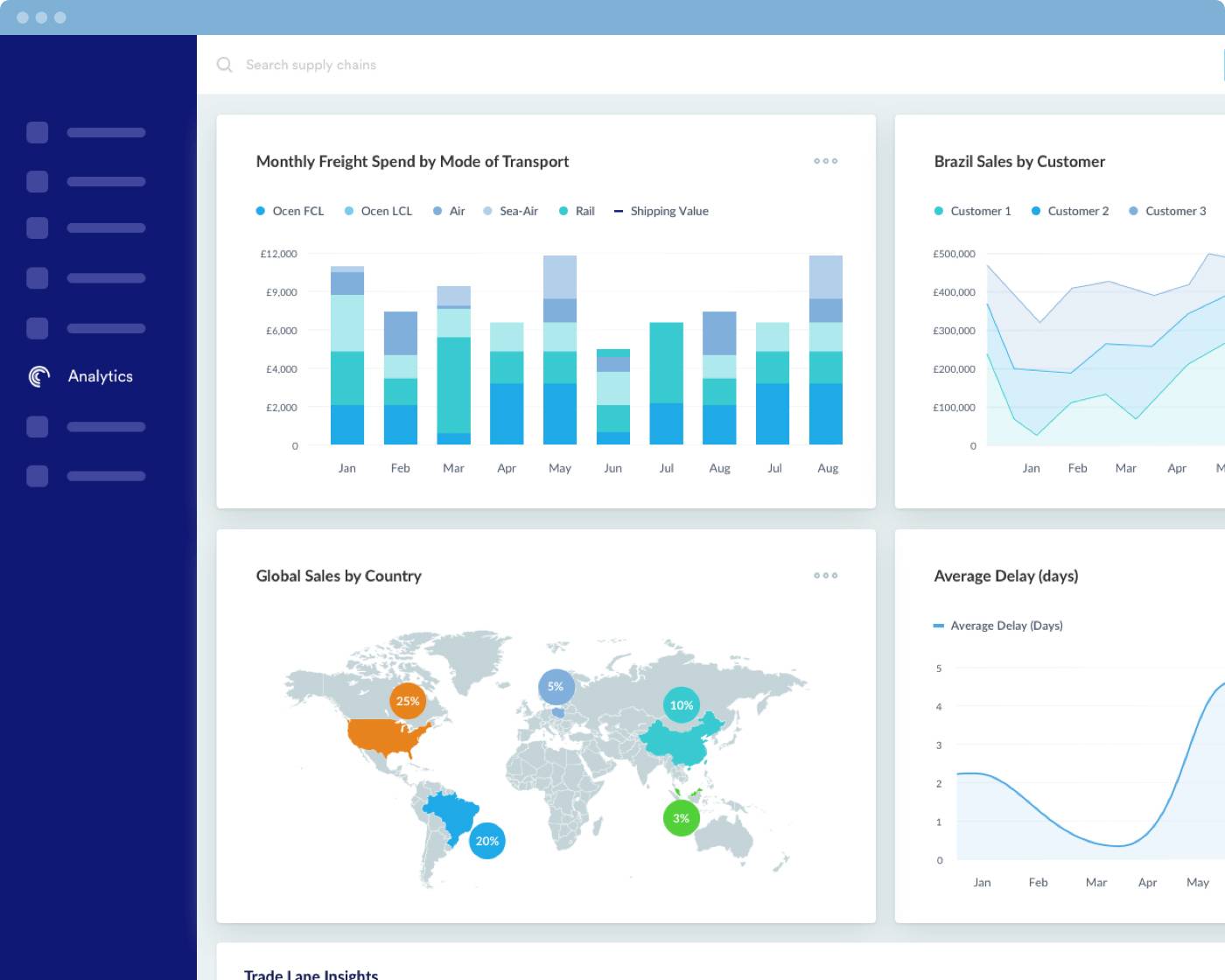

Managers of such companies constantly compile internal reports on the status and location of cargoes to Customers and promptly notify the Client about important changes in the movement or condition of their cargo. Also, the Customer can at any time give a request about the status of the cargo and is guaranteed to receive reliable information.

This is an optimistic scenario. However, even this is not enough. A new era has come, and it is technologies that today take the transport business to a new level. Many freight forwarders who really cared about their customers have already caught this trend, however in 2019 they are still in an insignificant minority.

Online Logistics Sales

What hinders the development of online sales in logistics and why the future is not at all for phone calls?

It is predicted that the turnover of B2B Internet sales (business-to-business, sales of companies to companies) will be twice larger than B2C by 2020 and will amount to $7 trillion, or 27% of the total world trade.

Let's imagine the following scene: in 2020, Michael, purchasing director at an electronics store, gets his smartphone out of his pocket, and sees a hot corporate proposal for ordering twenty LCD TVs from Philips at a factory in Guangdong. Drinking coffee, Michael presses the "Buy" button and goes to the delivery page, where the exact cost of shipping his order from several transport companies is calculated in real time. Here he can see the rating and reviews of carriers. Michael selects the appropriate carrier and presses the “Book” button. A day later, all twenty televisions are already in his store.

Sounds unrealistic, right?

But it is already possible!

In less than 20 years, online commerce has changed the entire global economy. Online shopping has become the daily norm. For example, in 1995, less than 0.5% of airline tickets were purchased via the Internet; in 2012, this figure exceeded 60%.

Guaranteed availability of purchase, accurate cost and fast delivery increase the chances of the trend spreading further beyond the consumer market. The annual growth of business-to-consumer-sales is 17% in the world. And this trend has not bypassed any country: for example, the Chinese online retailer Alibaba broke all records in 2016, when the site’s sales exceeded $ 14.3 billion in one day (on the so-called “Bachelor’s Day”, which is celebrated in China every year November). This is more than the annual GDP of Laos.

The rapid growth of Internet commerce has become achievable thanks to the development of international courier delivery. It can be noted that full-service offerings (processing and storage of orders) are experiencing rush demand and development: delivery within one hour and instant calculation of the cost of delivery to the buyer's door is no longer a myth. Courier delivery opportunities opened the door to global trade in goods and services.

This state of affairs suggests that the same purchasing director, Michael, who booked tickets at Onetwotrip, the hotel at Booking.com, calls Uber-taxi, buys a hat at Next and buys books at Amazon, does not want to use the old, labor-intensive, technologically backward management method and the formation of procurement. He will not call dozens of people to obtain information about prices and conditions, prepare and sign a bunch of invoices, payment sheets and acts, and then call transport companies for a long time to deliver the purchase at the right time for an acceptable cost, without fear that the goods will arrive in safety ...

Companies have been trying to attract partners through websites since the mid-1990s. But it seems that only now their attempts are beginning to pay off. According to The Acquity Group, an American e-commerce consulting company, 94% of corporate buyers are looking for information about potential suppliers and customers on the Internet. And often it is not only limited to search: in 2014, 66% of the surveyed companies had an average bill for the purchase on the Internet of$ 5000.

Delivery distinguishes B2B from B2C

Although in many respects corporate online sales are no different from consumer ones, the main difference is delivery. The average volume of a corporate order far exceeds the size of the consumer, and the problem is that transport companies are far from the development and speed of courier services. Without an instant freight calculation and delivery completion confirmation, the growth of B2B online sales is impossible.

SeaRates analysts decided to do a little research on the readiness of leading transport companies to the challenges of the new trend.

Less than a half of the 25 leading companies in the transport and logistics market have calculator on the site. And only two companies have the opportunity to book freight online.

At 18 companies’ sites you can send a shipping request, the rest do not provide any information about the tariffs on their sites.

In the meantime, only Europeans make online purchases of 1.3 billion Euros daily. On average, 5.4 million European users per day only visit the top three online stores - AliExpress, eBay and Amazon. The cart of online purchases is completely different - from books and tickets to furniture and gadgets.

What prevents companies from ordering transportation online?

First, when buying from the online store, the buyer is not asked to take care of the delivery on his own, he is only informed about the cost and delivery time.

Secondly, the matter is often in inconvenient use of web services of transport companies that cannot be integrated into the supplier’s Internet site: the complex and lengthy process of filling in an application is the need to specify the exact size of the cargo, an excessive choice of non-critical functions for the consumer (direct or groupage transportation van or awning, rear or side loading - what difference does it make to me?).

Thirdly, the transportation can not be ordered on site. After sending the application, the logistician or manager will contact you and ask all the data again. Then it's easier to call right away.

And for those two transport companies - with the ability to book the service online - the process of filling in numerous forms (you may not know the answer to some questions at all!) takes more than 15 minutes (> 25 clicks)!

For effective online sales, it is necessary that the entire process — from the application to organizing the delivery of transport, including payment, confirmation and notification of the status of the order takes place online and quickly.

Another interesting fact of our study was the big difference between the tariffs of companies, which according to various estimates reaches 286%. Of course, you need to take into account many factors that affect the formation of the tariff - type of delivery. Most companies do not disclose the logic of tariff calculation, and they cannot be justified given such a significant difference between prices.

80% of the market is in the hands of private entrepreneurs and individuals who can afford to take an order for 50% of the cost. They do not pay taxes, do not run call centers and do not spend money on repairs or diagnostics of vehicles...

As for the logistics companies themselves, the disadvantages of traditional methods for processing applications, including the maintenance of call centers and numerous logisticians, result in huge amounts of annual costs. Of course, transport companies transfer these costs to the customer. Therefore, the transition from calls to online sales will be beneficial for both cargo owners and carriers - this will reduce prices, increase tariff transparency, speed of application processing and the effectiveness of logistics services in general.

New official documents claim that the largest freight forwarders are losing business and the potential for huge growth in B2B online sales.

The results of the study by the method of "secret buyer"

Researchers at SeaRates placed identical inquiries put on behalf of a large American retailer for LCL cargoes from China to California, on the websites of the world's top 20 forwarders.

The results were disappointing. 6 freight forwarders did not even have a request form. Of the remaining 12, they could not immediately give an offer, and four did not respond at all.

The companies that ultimately made an offer, demanded numerous clarifications, indicating the imperfection of their request form.

In the end, only 45% provided a quote. The fastest response took 30 hours, the slowest - 150 hours. Only five companies followed the possible sale after submitting a quotation.

The lack of an instant opportunity to provide customers with online services suggests that freight forwarders will lose, as B2B online purchases will become a big part of the business.

The study should note some points. Our specialists used online quotation forms only where no login is required; and freight forwarders will undoubtedly argue that logging in is a key factor. However, such a statement is contrary to the policy of openness, and other potential customers again stumble on obstacles that will cause further delays. And this is not the highest level service.

We at SeaRates are not independent researchers. Freight forwarders use our technology to automate bookings and freight quotes online.

However, since buyers use Amazon and Alibaba, without thinking, there is no doubt that businesses also expect to provide online services without restrictions.

Also, there are certain problems specific to the logistics industry, such as the 41% difference between the lowest and the highest freight costs. It is also associated with the shadow policy of many companies, both shippers and freight forwarders.

Below is the summary infographics:

“Sometimes we can request rates for one route from five different offices of our company and receive five different prices from the same forwarder,” said Michael Horbs (Invasion International) in an interview with SeaRates. According to him, the lack of a global repository of freight rates as well as poor technological solutions for big data make it difficult for the company operating international export activity to work efficiently,” the statement said.

We invite you to join our open group for communication on international transport activities, as well as our Telegram channel for shipping innovations and industry updates - join us now!