Liner carriers, through their agents, issue to the shippers their own bills of lading showing the specific conditions of carriage.

These conditions follow the recommendations made by BIMCO - the Baltic and International Maritime Conference, Copenhagen - which is an international association of shipowners, brokers, agents, P&l. Clubs and other concerns involved in sea trading, regulating the correct enforcement of maritime procedures, in particular those regulating the layout of bills of lading and contracts of affreightment (charter parties).

In short, a bill of lading:

- constitutes evidence of the contract of carriage entered into by the shipper and the carrier

- states the terms and conditions of the contract of carriage

- is a document of title and a cheque for goods, instrumental to the right to take re delivery of the cargo, to which the consignee/receiver and/or any third party holder of the bill of lading is entitled. What a cheque is to money, a bill of lading is to goods.

The bill of lading is a document showing the right to obtain from the carrier the re-delivery at the destination of the goods therein described. The property thus acquired may then be disposed of through transferring the title by endorsement (stamp and signature on the back of the front page of the document).

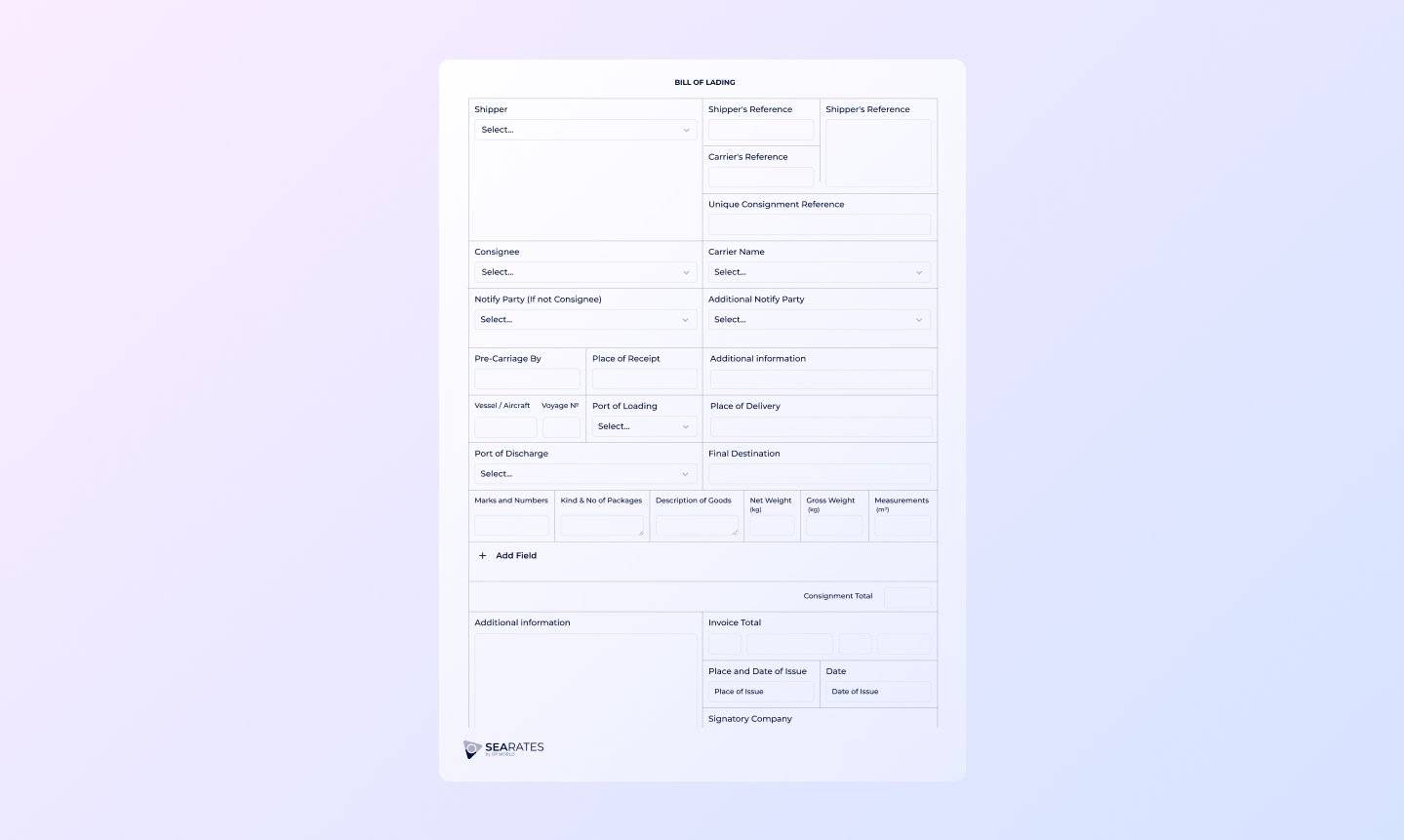

A bill of lading is considered invalid when any one of the following three specifications is not shown on it:

1. the description of the goods, required to ascertain that they correspond to the buyer's order

2. the date of issue, which is normally the date of sailing of the carrying vessel

3. the signature identifying the carrier through the agent who signed the bill of lading for and on behalf of the carrier

The omission of any other indication, whether compulsory or not, does not invalidate the document

By issuing a bill of lading, the carrier fully commits himself to carrying the goods from a port of loading to a port of destination. He there redelivers them to the holder of any one original of the same bill of lading, inasmuch as the bill of lading constitutes evidence of the contract of carriage between the seller/shipper of the goods and the carrier against payment of the relevant sea freight.

In order to be able to obtain from the carrier’s agent the full 'set' of the b/l, the seller will have to:

- book the required space on board the carrying vessel

- obtain the number of the booking

- agree with the shipping agent the latest date acceptable to make the cargo ready for shipment

- obtain a suitable empty container for stuffing

- deliver the stuffed container to the carrier’s terminal

- obtain confirmation that the container was actually loaded into the ship

- settle the sea freight and the local charges

On presenting the bill of lading to the bank, together with the other prescribed documents, the seller may negotiate the credit. In other words, he obtains payment of the price of the goods agreed with the buyer by collecting the relevant amount of money made available by the advising bank as instructed by the issuing bank.

This done, all obligations towards the shipper are performed and the property of the goods is automatically transferred to the buyer.

During the transportation, the carrier retains the possession of the goods entrusted to him by the shipper, who identifies himself with the seller/exporter.

Conventionally, however, the ownership of the goods is transferred to the buyer when the goods are loaded into the ship.

At this juncture, the bill of lading becomes fully operative. In other words, as already evidenced it constitutes not only a receipt for the cargo but also evidence of the contract of carriage as well as a transferable document of title, which identifies the party entitled to the right over the same goods or their countervalue.

This explains all the precautions to be strictly observed in case the bill of lading originals are lost or arrive late in the hands of the party concerned. In fact, any one original of a bill of lading, unduly circulating, may result in the goods being delivered to an unauthorized party.

It may well happen, in fact, that an agent delivers the cargo to the holder of an original bill of lading, erroneously regarding him as the rightful holder, only for the owner to then find himself bound to refund the countervalue of the goods to the holder of another original of the same b/l who can prove himself to be the legitimate consignee of the cargo.

Where goods have been sold on CIF terms - i.e. on freight prepaid basis - the contract between the shipper and the carrier is usually deemed to be accomplished with the negotiation of the credit and the concurrent transfer of the ownership of the goods.

On the other hand, in the case of a FOB terms sale - i.e on freight collect basis - the shipper remains liable to the carrier for the payment of the sea freight until the buyer has taken delivery of the goods and paid the freight. The shipper is equally liable for the payment of the freight should the receiver fail to withdraw or take delivery of the goods on their arrival at destination.

Normally, in case of CIF sales, it is up to the seller/shipper to nominate the carrying vessel, pay the sea freight, and arrange for the insurance coverage as provided by the credit.

In FOB sales the choice of the carrying vessel is left with the consignee/buyer of the goods, who is responsible for the payment of the sea freight to the carrier’s agent of the port of discharge.

According to the details shown in the b/l, of which as many originals and not-negotiable copies will be issued as required by the letter of credit (usually three and five respectively), the carrier will issue the cargo manifest, the freight manifest and the delivery order(s) to enable the receiver(s) to take delivery of the goods, even in split consignments, under one and the same b/l.

Like any other document of title, a bill of lading may be issued to the holder (a practice seldom in use), to a named consignee, to order or to order of.

- to the holder: the owner of the title may rightfully claim the delivery of the goods on presentation of the title. The transfer of the title takes place by simply handing over the document to another party.

- to a named consignee: in this case the consignee/receiver is clearly nominated in the b/l which is a straight b/l and is worldwide not negotiable. In such a case the goods must be delivered only and exclusively to the party specifically nominated in the bill of lading (as receiver of the cargo).

- to order or to order of: the holder of the b/l is at liberty to transfer the title at any time either in blank, without nominating any third party (to order), or to a third party of his choice (to order of), indicating the name of the endorsee on the reverse of the b/l, duly stamped and signed. In the case of goods that are quoted on the Stock Exchange, such as coffee, bills of lading made out to order allow the transfer of the property of the goods during the sea carriage and may be endorsed more than once.

Obviously, all the issued originals of the bill of lading must be equally endorsed by the party having the authority to do so. This is to prevent delivery of the goods, or their countervalue, being unlawfully claimed by a person upon production of an original of the b/l not duly endorsed, illegitimately retained, or accidentally fallen into his hands.

While on this issue, it is worth mentioning that despite all the precautionary measures set up by international conventions and general practice through the years to protect shipowners’ interests from losses consequent upon unlawful or mis-delivery of cargo, as much as 20% of bills of lading circulating in international trade are false or fraudolent.

A great help has been provided in recent times to shipping companies/carriers and their agents worldwide by the International Chamber of Commerce who have set up the International Maritime Bureau, an anti-crime bureau, which received the support by I.M.O. and more recently was granted the ‘observer status’ with Interpol.

The task of I.M.B. is to carry out investigations, prevent fraud in international trade and maritime transport, authenticate suspect bills of lading and bring perpetrators of frauds to justice with a view to recovering losses.

A b/l showing only the stamp and the signature of the shipper/endorser is said to be blank endorsed. In such a case the b/l made out to order becomes a bill of lading to holder. By the way the same b/l ‘to order’ may be endorsed once or more times.

The bill of lading is endorsed to a nominated party when, in addition to his stamp and signature, the endorser also states the name of the party to whom the goods are to be delivered (to the order of).

B/L is not negotiable unless consigned (issued) to order. Such wording automatically implies that b/l may be issued also to the order of.

Upon arrival at destination the goods may be re-delivered to whoever presents one of the original bills of lading (the total number of which is usually shown in the same b/l) duly issued to his name or blank endorsed.

The carrier, who has issued the b/l through his agent at the loading port, is entirely responsible to the holder of the title to the goods for what is shown in the b/l. This is why he, the carrier, has to take every possible measure to avoid the risk of being held responsible for non- or mis-delivery of the goods as set out in the b/l.

The first original b/l presented by the legitimate receiver to obtain the redelivery of the goods at the port of discharge renders all other existing originals of the same b/l null and void.

Usually, a b/l is issued in three originals "all of the same tenor and date, one of which being accomplished the others to stand null and void".

By collecting from the legitimate holder of anyone original b/l, and its acquittance by his agent at the port of discharge, the carrier is relieved from any further obligation. B/L are usually issued in three originals as a precaution, since any one of them may go astray, or its arrival at destination may be unaccountably delayed.

The contents of the b/l are drawn up on the basis of the specifications supplied by the shipper, and must be in accordance with those shown in the letter of credit. However, they may at times contain mistakes, which could be detected after the document has been released and forwarded to the consignee.

Given that the contents of each b/l are quoted in the cargo manifest, the customs at the port of discharge, upon spotting a mistake, for instance, in the number of packages, will not clear the goods unless a manifest corrector is provided as rapidly as possible by the issuing agent.

This is a document which, with reference to the cargo manifest, states, for instance, that the number of packages shown in the manifest is wrong, and gives the correct number.

By this procedure, the customs clearance of the goods is normally obtained against payment of a fine by the carrier through his agent at the port of discharge.

The b/l must be issued before the expiry date of the letter of credit. To overcome this obstacle, shippers often insist on obtaining predated b/l against a letter of guarantee. As a matter of fact, banks are most reluctant to agree to an extension of the expiry date of the letter of credit. However, a letter of guarantee for pre-dating a b/l, or a letter of indemnity for the issue of a ‘clean’ b/l, cannot be accepted by the carrier or his agent .

The acceptance of a letter of guarantee for predating a b/l, or of a letter of indemnity for the issue of a clean on board b/l, does not exempt the carrier from his responsibility. On the contrary, such letters constitute an offence against the law and evidence of a false statement and the carrier will be held responsible, jointly with the shipper, for any possible damage caused to the receiver.

In fact, the purchase of goods after the date established by the letter of credit, which is the ultimate date fixed by the buyer, might no longer be profitable on account of changes in market conditions in the interval. Should such a case occur, however, only the seller is liable to make good any possible loss of profit.

It should be noted that the fraud associated with the non-observance of the due date stated in the letter of credit can be easily discovered by whoever is concerned (bank or buyer/consignee) by simply requesting the port authority of the port of shipment to indicate the actual sailing date of the proposed carrying vessel.

Likewise, since the carrier is not in a position to ascertain the nature and the stowage of the goods into the container (FCL) - which is why the b/l shows the wording said to be or said to contain - any confirmation by the carrier that the cargo is free of faults and defects would clearly be regarded, in the absence of a proper investigation to this effect, as a false statement by the carrier himself.

This would enable the receiver to take legal action against him.

By contrast, a b/l which, although correctly dated, is not withdrawn by the shipper within the due time limit, becomes a stale of date b/l, and might not be accepted by the bank for the negotiation of the credit.

However, in the absence of any irregularity, and after withdrawal of the full set previously issued (originals and non-negotiable copies), the carrier may issue another full set of the b/l showing the actual date of loading.

By selecting a carrier of his choice, a shipper implicitly accepts the carrier’s b/l conditions, knowing that his interests are safeguarded through the acceptance by any carrier of the rules and regulations provided by international conventions.

Since each b/l must show the container and seal numbers of all units of the same shipment in accordance with the letter of credit, in cases where the units are too numerous for them all to be listed in the limited space provided in the boxes named 'marks and numbers' and ‘description of goods’ in a b/l form, the following wording is typed in the mentioned space: “containers’ data as per attached ‘rider’ “

All data relating to the relevant shipment are then listed on a separate sheet of paper marked with the wording ‘rider to b/l nr. xy issued at... and dated...’, clipped to a bended edge of the relevant b/l.

The edge is to be stamped, and the stamp signed by the issuing agent to enable all concerned to recognize the b/l and the 'rider' as one and the same document.