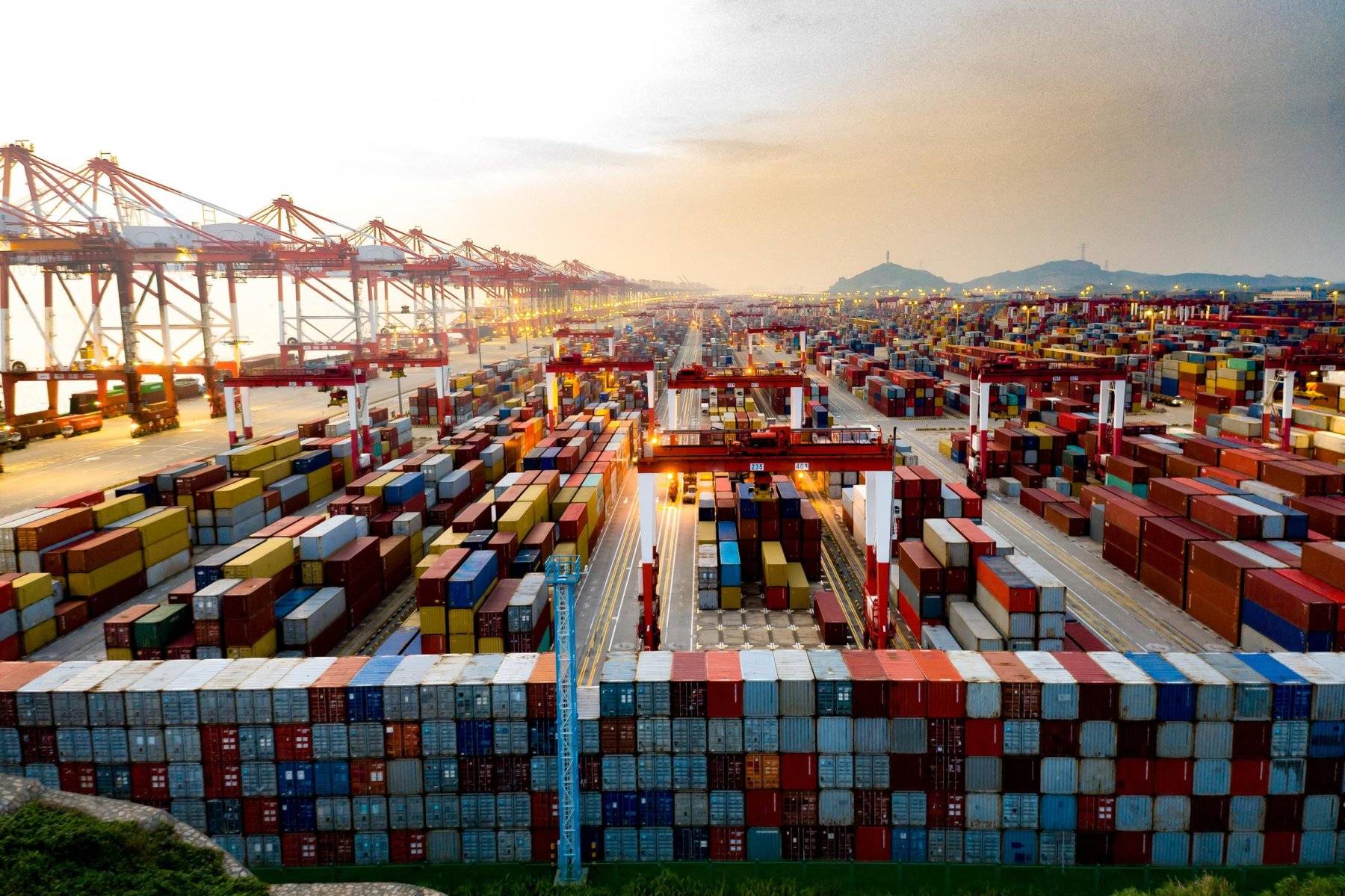

As globalization increases, so does the complexity of managing suppliers, transportation, product delivery, and payment processes. This complexity is what fuels the continued evolution of supply chain finance models.

These solutions are intended to optimize cash flow and minimize risk by allowing businesses to manage their receivables and payables better. A combo of technology and modern financial tools streamlines transactions across international borders.

With that in mind, here’s a closer examination of how supply chain finance is changing and what this means for businesses across the supply spectrum.

The Evolution of Traditional Supply Chain Models

Traditional supply chain finance models were simple. There was a clear start and end point in every transaction, from sourcing raw materials to delivering finished goods. But as commerce grew more international, so did its intricacy.

Traditionally, suppliers would offer products or services without immediate payment. This created a gap between delivery and compensation that often strained relationships between producers and buyers due to longer payment terms.

Then came the inclusion of banks and other third-party financial institutions into this equation. Their role was to bridge this gap by offering early payments to suppliers while extending buyer payables to iron out the kinks at both ends, reducing costs as a result.

As time passed though, these traditional models started showing obvious cracks under an evolving global economy's weight. Flawed guarantee systems, lengthy document handling times, a lack of real-time visibility and limited control over transactions are just a few issues that emerged.

This is why modern solutions arose, aiming at overcoming these challenges to create the streamlined, efficient models for global supply chain management that we see today.

Emerging Technologies in Supply Chain Finance

Technological advancements have catalyzed stunning changes in the supply chain finance sector. Let's delve into some of these emerging technologies:

- Blockchain Technology: This decentralizes trade transactions, enhancing security and transparency and eliminating miscommunications.

- Artificial Intelligence (AI): AI has a significant impact on automating administrative tasks and reducing human errors.

- Internet of Things (IoT): IoT offers real-time insight over complete inventory management, ensuring minimal wastage and enhanced business efficiency.

- Robotic Process Automation (RPA): RPA strategies take care of tedious manual duties, increasing accuracy and productivity as a result.

- Cloud-Based Solutions: These offer scalable platforms facilitating collaboration between all stakeholders.

Adopting these tech trends assures various benefits such as process automation, data optimization for decision-making, and fraud reduction measures, among others, creating a robust system nurturing growth avenues across global supply chains overall.

Risk Management in Modern Financial Frameworks

Mitigating risks is a core focal point within modern supply chain financial models. Let's consider some risk management strategies applied today:

- Investment in Technology: Implementation of automation, the rise of AI, and the integration of blockchain technology reduce fraud risks significantly.

- Agile Supply Chains: Operating an agile business model minimizes disruption associated with unpredictable market changes.

- Diversification of Supplier Base: This ensures that operations won't halt if one supplier faces obstacles.

- Compliance Monitoring Systems: These identify regulatory issues before they become costly fines or reputational damages.

It’s essential to remember that each company's circumstances are unique and thus require a tailor-made approach to managing potential pitfalls along their individual operational routes.

Overall, the ultimate goal for improved risk management feeds into creating sustainable business operations capable of weathering any unexpected situations gracefully.

Supply Chain Finance Meets Contractor Financing

When we talk about supply chain finance evolution, it's essential to consider innovative solutions like contractor customer financing. This concept has strong parallels with the nature of supply chain finance.

In contractor customer financing, contractors or service providers offer their customers financial aid to handle projects' upfront costs. It strengthens business relationships while ensuring project completion without budget constraints.

Similarly, in supply chain finance, suppliers and buyers establish a symbiotic relationship where early payments are made possible by the buyer (through a financier), hence reducing the pressure on suppliers’ cash flow.

Merging such concepts could lead to new pathways of efficient financial planning strategies across industries, in turn improving operational fluidity all around across diversified sectors.

Fleet Vehicle Financing vs Supply Chains

The principles behind fleet vehicle financing can offer surprising insights when considered in a supply chain finance context.

Whether you’re in the market for top compact SUVs or looking to cut costs by investing in, let’s say, a selection of used Peterbilt 579 Trucks, like the ones at Charter Trucks. In both scenarios, staggered payments and tailored financial plans are crucial for managing budget constraints over time, which is similar to how supply chain solutions provide early payment opportunities to suppliers while extending buyer payables that balance overall cash flow.

Looking closer at these parallels paints an interconnected picture between verticals that are otherwise seemingly separate from one another. It brings out hidden strategies that are applicable across the board, whether you're optimizing global trade routes or simply fixing your vehicle acquisition processes.

Future Predictions of Next-Gen Financial Models

The evolving nature of supply chain finance offers a compelling glimpse into the possibilities ahead. Here are some predictions for next-gen financial models:

- Increased Technological Integration: As mentioned, the future will see an enhanced use of AI and blockchain in managing, securing, and streamlining transactions.

- Sustainable Supply Chains: An increased focus on environmental responsibility is sure to dictate future models.

- Greater Transparency: Open book contracts that promote transparency at every level can become the benchmark.

- Completely Digital Transactions: As we move towards a cashless society, all aspects of supply chain finance may go digital.

Finances within global trade routes are headed towards exciting frontiers. As such, businesses must keep close tabs on how they progress, simultaneously balancing innovative advancements with responsible practices while continuously improving supplier-buyer relationships.

The Bottom Line

As you can see, the evolution of supply chain finance mirrors a larger trend in global commerce, which is shifting towards a more integrated, technology-driven, and sustainable model.

Examining these developments means anyone can find actionable strategies for their own business. Moreover, it's clear that to thrive in the modern economic landscape, adaptability, and agility are critical. Keeping an eye on unfolding trends is better than sticking to the old ways of doing things.