The ocean freight market is tough to navigate:

massive price swings, volatile spot pricing, minimal visibility into

value for services, and a general lack

of transparency are just a few of the headaches shippers likely know too well.

Today, prices continue to be erratic, vessel operating common carriers — often referred to as ocean carriers — are still consolidating, tariffs are in seemingly constant flux, and strict pollution controls are directly impacting fuel costs. Now, more than ever, blank sailings, rolled shipments, equipment shortages, port congestion, and surprise fees are all very real concerns.

For unprepared buyers, these trademarks of volatility aren't just inconveniences, they're pitfalls that can ultimately cost precious time and hundreds of thousands of dollars. While there's no guaranteed recipe for success when it comes to navigating the tumultuous seas of ocean freight, there are a few steps buyers can take to help ensure smooth sailing for their shipments.

This guide by Essay4Students will help you make the most of interactions with your ocean transportation service provider, get full and transparent quotes, and ask the right questions before you sign, to maximize your buying power. Your reward will be enhanced transparency, tailored pricing options specific to your supply chain needs, competitive rates, and better control of your supply chain.

Let's dive in.

Consolidation and market effects

Over the course of four years, the number of major ocean carriers dropped from 20 to 10 , and the consolidation trend is showing few signs of stopping.

>> According to Natalie Tserkovnaya, Head of Ocean Freight at SeaRates, carrier consolidation was an effort to deliver market stability, ensure capacity, and improve efficiency in response to the market uncertainty following the financial crisis of the early 2000s. Spurred on by the rise of mega-ships — capable of carrying more than 8,000 TEUs at a time — and the need to fully utilize the capacity of large vessels, consolidation has continued to be a major trend across ocean freight.

Despite the rise of carrier alliances, the ocean freight market continues to be volatile. Large carriers and alliances are struggling to adapt to even greater fluctuations in demand as they continue to pursue profitability. To make matters worse, prices have continued to be unstable since the market crash in 2008. Working together, these factors have combined to create a difficult landscape for shippers and ocean transportation service provider alike.

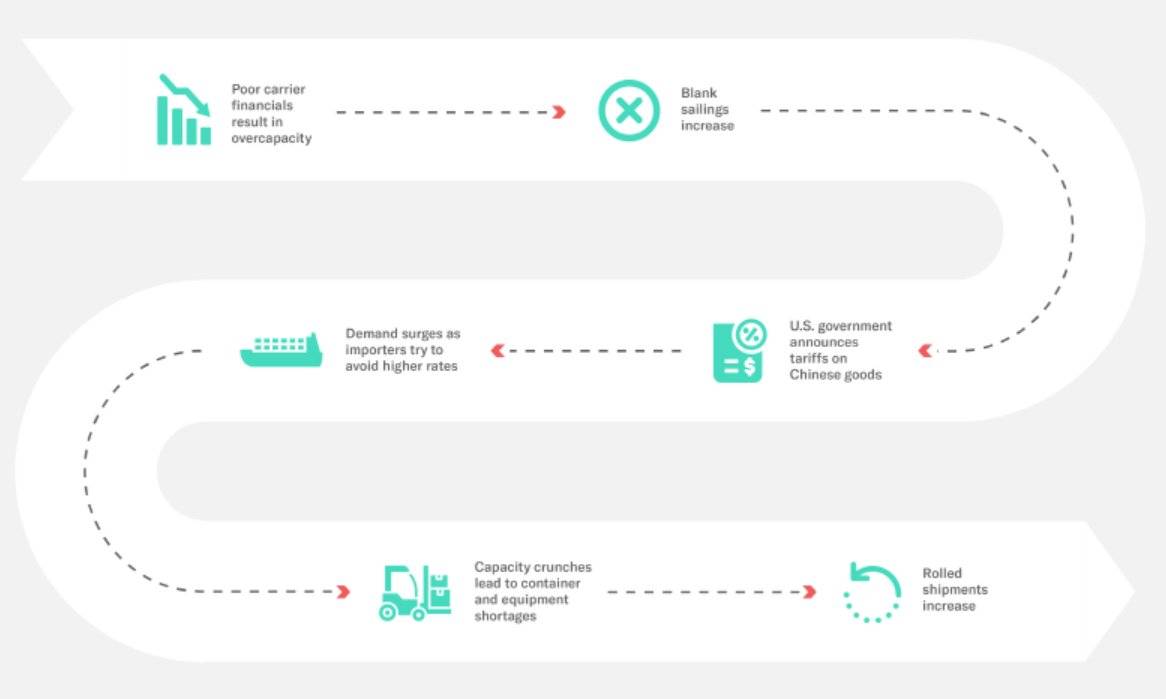

Tserkovnaya adds that the impact of these market effects was felt directly in 2018 when poor carrier financials resulted in surging overcapacity and a rise in blank sailings. This trend of cancelations was shortly followed by the announcement of a 10% U.S. tariff increase on $200 billion worth of Chinese goods with a possible additional increase to 25%. To beat the pending tariff deadline, shidppers drastically increased demand to get goods delivered at a lower rate. This caused a domino effect that culminated in far-reaching equipment shortages both in containers and in equipment to load freight. Poskus points out that market conditions caused containers to roll and spot pricing to surge nearly 100% over the course of a single month, while fixed-rate contracts became very strictly managed due to space allocations.

In short, the multitude of factors at play in ocean freight make the market unpredictable at best.

A Cumulative Effect: Ocean Freight in 2018

Buyer Beware

>> In some cases, fixed rates and spot pricing become a numbers game. Attractive rates are promised during bidding season, but as peak seasons roll around, spot pricing delivers a much higher return. With tariffs, port strikes, and inclement weather constant possibilities, spot pricing can make carriers significantly more money than fixed contracts.

Likewise, non-vessel operating common carriers, also commonly referred to as freight forwarders, secure space based on allocations and agreements with ocean carriers. During the slow season, freight forwarders may move fixed-rate cargo to the spot market to secure cheaper rates and pocket the difference. Doing so may prevent the freight forwarder from meeting fixed-rate cargo commitments made with ocean carriers, and result in higher prices for shippers during peak season. When freight forwarders fail to adhere to their ocean carrier agreements, capacity and rates are directly affected.

And that’s just the beginning. Coming into effect on January 1, 2020, IMO 2020 — a regulation intended to lower sulfur oxide emissions by 85% — has resulted in additional costs for importers as ocean carriers look to offset an estimated $15 billion increase in fuel expenses.

The lesson for buyers? Understand what you are committing to, deliver on your agreements, and hold all your freight forwarders to the same level of excellence and performance.

Make your mark in the ocean freight market

So the question remains, how can buyers find reliable, repeatable value in a market that is so prone to massive fluctuations? The key lies in the way many people approach purchasing consumer goods — asking questions.

To succeed in global trade, buyers must start with a partner they trust. SeaRates' ocean freight leader, Tserkovnaya, has drawn on her deep industry knowledge and hands-on experience to offer keen insights into how supply chain technology, data science, and Al empower ocean freight buyers. According to Poskus, the following are questions you must ask before signing on the dotted line.

What kind of commitment are you making?

>> Most conversations with freight forwarders follow the same formula: establish cost from point A to point B based on minimum quantity commitment (MQC) and available TEUs.

This sounds clear enough, but vital details often go unmentioned. To reduce risks to your supply chain, there are a few key points to hone in on.

Ask your freight forwarder:

□ How many TEUs can you actually commit to on a weekly and monthly basis?

□ What happens if you don’t deliver?

□ Could your committed capacity be cut?

□ How likely is my cargo to get rolled?

□ How many carriers are covered in your proposal?

□ What back-up carriers do you have?

□ What is your issue-escalation process?

Don’t let a hurried conversation with unclear implications result in your signing on unfair terms and conditions.

Is the price too good to be true?

>> Say a freight forwarder gives you a quote for an unbeatable price. The deal might seem like a no-brainer, but not so fast. Take the time to scratch beneath the surface.

To begin with, confirm the promised sailing is actually backed by an ocean carrier and how many sailings and ocean carriers are covered. If the freight forwarder is gambling that they can take your cash now and buy inventory more cheaply on the spot market, you could end up with the short end of the stick. More specifically, you may end up footing the bill for additional costs just to get goods on a ship or, worse, your shipments may end up landlocked due to lack of capacity, or your bookings may be rejected or rolled to the next sailing.

Even if the quote is backed by an ocean carrier, keep in mind that shipping lines may cease service for any number of reasons, from incorrect loading factors to bankruptcy. In 2016, the sudden bankruptcy of Hanjin Shipping Co. resulted in 98 vessels and more than 500,000 TEUs being refused entry at ports worldwide.

A good rule of thumb to protect your shipments from the fallout of events such as shipping line bankruptcy is to ensure your freight forwarder can serve your business across multiple ocean carriers. In the case of Hanjin, an informed freight forwarder would have recognized the risk early and shifted goods to another ocean carrier to keep them from being lost at sea.

With IMO 2020’s limit on sulfur content in ship oil,

failing to account for BAF means you could get hit with

higher prices as a result of cleaner fuel requirements.

How will environmental regulations and tariffs impact your shipment?

>> The bunker adjustment factor (BAF) is a formula that accounts for freight charge additions to protect ocean carriers from fuel price fluctuations. BAF is always assessed per container and based on the Brent Crude oil price, but different ocean carriers, and freight forwarders, may use slight variations when calculating surcharges.

With IMO 2020’s limit on sulfur content in ship oil, failing to account for BAF means you could get hit with higher prices as a result of cleaner fuel requirements. For example, a shipment of 1,000 TEUs could net additional costs of more than $24,000 should bunker prices increase by $100 per ton.

Be sure to confirm any agreed-upon fuel formulas and double check that the formula does not include hidden fees.

Considering that fuel is estimated to account for half of an ocean carrier’s operating expenses if fuel prices rise 25% in 2020 as predicted , then surcharges in the 10-15% range should be considered reasonable, according to Poskus. However, keep in mind that factors such as sailings longer than 14 days, vessel size, and scheduling delays may result in higher costs.

And the same can be said for tariffs. Do your homework and establish how the latest tariff rates will affect your imports. One resource: SeaRates plans to offer a free online tool that provides import duty estimates for goods shipped from China. If you have concerns about tariff patterns or are uneasy with the direction tariffs are heading, consult your freight forwarder or customs broker and adjust your plans as necessary.

Additionally, partnering with a freight forwarder that is enabled by data-driven solutions can deliver more transparency into your supply chain. By identifying key data points and assessing performance in tandem with your forwarder, you can increase efficiency and profitability.

The more you understand your financial responsibility as a buyer, the better you’ll be set up for success.

Is your space guaranteed in peak season?

>> During peak shipping season — mid-August through mid-October for TPEB and FEWB — containers and shipments are at higher risk of getting rolled by ocean carriers. But that doesn't mean you can't gauge your risk and be prepared.

Be proactive and investigate your options in the event your cargo gets rolled. Factors such as vessels missing port or sailings overbooked may be out of your freight forwarder's control, so your hands may ultimately be tied. Conversely, rolled cargo resulting from incomplete or untimely paperwork may fall squarely on your forwarder's shoulders and should be addressed urgently. Either way, it's important to be prepared.

And at least part of that preparation should include understanding the frequency or rate of rolls. Don't be afraid to broach the topic directly with the forwarder itself or a client reference. An ocean carrier with a 3% roll rate is much more reliable than one with a 10+% rate. Do your best to find out who gets rolled first and last and why. You may not get any guarantees, but you deserve clarity on the risks you run.

Does your freight forwarder have references?

>> One sure-fire way to gut check a prospective freight forwarding partner is to check references. Net promoter score (NPS) — a metric used to judge a company's customer loyalty — can be an excellent indicator of a partner's commitment to customer service and reputation for quality service. The higher a company's NPS, the more reliable the experience working with them will be. Additionally, talking to an existing customer shouldn't be out of the question and can be an excellent barometer of your potential relationship. If possible, ask to speak with a customer who has shipped a similar amount of units or has agreed to conditions like the ones you are considering. Take advantage of that opportunity to ask about their experiences with fixed-rate promises compared to peak-season reality to get a clear understanding of your potential partner.

If the forwarder is reluctant to provide references, it may be time to start looking elsewhere.

Is your negotiation really as transparent as it seems?

>> You may find yourself in a situation where your freight forwarder wants to bring a dedicated ocean carrier into negotiations. At face value, this seems like a great move. You might get the opportunity to speak directly with the ocean carrier moving your goods — and there can be significant long-term advantages in establishing a relationship with an ocean carrier — but this access shouldn't be viewed as guaranteed protection from sky-high spot pricing.

Remember, part of a freight forwarder's value is its ability to work with multiple shipping lines to get goods from point A to point B for the best available rate.

When you commit to a single ocean carrier, you limit your flexibility. No shipper is immune to market factors that drive capacity and pricing. As a result, if things get tight, you may still find yourself subject to surge prices.

Building a relationship with an ocean carrier can be very beneficial for your business, but don't let perceived access and value mask the realities of the shipping market.

Conclusion: Ocean freight’s an ocean of liability. Don’t dive in alone.

Before you sign anything, be ready to ask questions and press for details. Keep this checklist as a reference:

>> Understand your commitment in granular detail.

>> Explore space guarantees and multiple back-up plans to mitigate the risk of cancellations.

>> Watch out for fuel surcharges and other hidden fees.

>> Choose a freight forwarder that’s up to date on all the changes to the ocean freight market and has the technology, analytics, and hands-on supply chain expertise to make you a successful player in it.

Today there are fewer ocean carriers than ever. With less competition, each ocean carrier can command higher prices and add more — sometimes very surprising — fees. To get the most value for every dollar spent on shipping costs, it’s important to thoroughly vet freight forwarding partners and remain an informed customer. Carefully preparing to face an unpredictable ocean market can help you navigate it successfully.

We invite you to join our open group for communication on international transport activities, as well as our Telegram channel for shipping innovations and industry updates - join us now!