The impact of Panama Canal restrictions on global supply chains is a pressing issue that's got the shipping world on edge. These limitations are shaking up trade routes, and it's crucial for businesses to stay informed about these changes. Recent measures from the Panama Canal Authority due to drought conditions.

As an industry, we are observing significant changes in the dynamics of global shipping, affecting the movement of goods across oceans. This includes extended delivery times and increased costs. By exploring the Panama Canal restrictions further, you will gain a comprehensive understanding of the current trends in transit times and the reasons behind certain shipping lines opting for longer routes around continents.

Whether it’s figuring out alternative maritime paths or tweaking operations, SeaRates wants to provide the insights to help your business adapt and understand these recent major moves in ocean freight.

Navigating the Panama Canal's New Reality

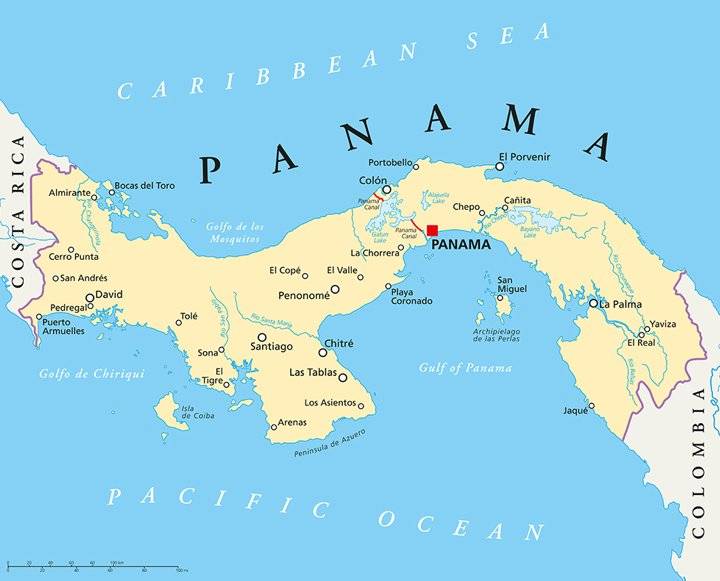

The Panama Canal Authority has reduced transit times, creating waves across global supply chains. The culprit? A severe drought that's brought Gatun Lake to its knees; just 81.3ft in January 2024.

The Severe Drought Prompting Unprecedented Measures

Reduced water levels in Gatun Lake adversely impact the operational efficiency of the Panama Canal. This is not a minor issue, as the canal is a crucial maritime route, essential for the seamless passage of ships between oceans. Currently, we are witnessing a decrease in the number of daily transits as a result of the Panama Canal drought. Transits are limited to approximately six, compared to the usual eight or nine in optimal conditions. This change highlights the canal's sensitivity to environmental factors and its importance in global maritime logistics.

Why does this matter? Well, each slot through this watery shortcut is like gold for shippers aiming to save time and fuel costs. But with fewer slots come bigger headaches—schedules get tight, meaning certain cargo shipments need to be rerouted via the longer path around South America. This adjustment is a strategic response to ensure timely delivery and maintain the flow of global trade under challenging circumstances.

Assessing the Impact on Global Supply Chains

The recent restrictions by the canal authority, while necessary due to lower water levels, significantly impact the logistics strategies of many companies. The reduction in the average daily number of transits – now restricted to single digits – has led to a considerable re-evaluation of previously dependable shipping routes.

Ocean carriers are promptly adapting their operations to address the ongoing Panama Canal issues and adapt to the changes, but the situation is complex, with large numbers of container ships vying for limited passage space. This situation right now is reminiscent of the Panama Canal delays six months ago, when the wait time was 21 days, resulting in substantial financial implications.

The Cost of Change for Shipping Companies

The introduction of additional booking fees is due to changes in the management of the Panama Canal. These expenses, seemingly minor on their own, accumulate significantly when considered on a per-vessel basis, impacting the delicate balance between maintaining competitive freight rates and preserving profit margins.

Ocean freight, traditionally known for its cost-effectiveness in covering vast sea distances, now faces the task of revising strategies to accommodate these extra charges. This is a demanding endeavor, especially given the current global economic climate, and considering that as recently as November 2023, canal slots had been auctioned for as much as nearly $4 million, adding further pressure to maintain reasonable pricing without compromising service quality.

It is a given that freight forwarders and shippers are also feeling the strain, as they are confronted with rising costs and escalating demand, pushing businesses to swiftly adapt to keep pace with orders while striving to uphold service excellence standards. Increasingly many are turning to digital transformation for innovative solutions to these logistical challenges.

Alternate Maritime Routes Gaining Traction

As the Panama Canal grapples with restrictions, shippers are eyeing the globe's map for detours. These are not easy alternatives or shortcuts but rather substantial reroutes that could reshape shipping lanes.

Cape of Good Hope as a Detour Option

The Cape of Good Hope is a familiar alternative as ships consider circling Africa to bypass Panama Canal congestion. This is not just about avoiding traffic; it’s a strategic play when transit times are on the line. The longer journey has captains scratching their beards, wondering if this route could actually work without blowing timelines and budgets out of the water.

Let's talk numbers: If you take 11 days on average through the canal, rounding the cape can add weeks to your trip. So why do it? Because sometimes slow and steady keeps supply chains moving.

Suez Canal Volatility and Red Sea Uncertainty

The Suez Canal, known for its fluctuating conditions, is also gaining media and industry attention, though not as a solution; current geopolitical tensions have led to multiple large carriers indefinitely pausing sailings through these shipping lanes, particularly in the Red Sea area. This pause reflects the industry's cautious approach to navigating these uncertain waters, as they closely monitor and evaluate the evolving political and security situations.

In truth, there are no easy choices currently for the global supply chain.

The Ripple Effect on Ocean Freight Operations

Ocean Carriers Adjusting Flagship Services

When the Panama Canal Authority decided to stretch coast transit times, ocean carriers were quick to shift gears. Now, with every tick of the clock, they're plotting new strategies and routes that avoid bottleneck blues.

For instance, in response to the Panama Canal situation, some carriers now offer longer but less congested paths. The global impact is clear: as vessels play Jenga around the canal's constraints, expect major shifts in shipping lanes—and do not be surprised if you hear "Cape of Good Hope" more often at port-side chats.

Gulf Coast-bound vessels? Shipping companies are becoming increasingly frustrated with the spiraling costs and extended transit times, potentially as much as 13% at present.

Container Ship Strategies Amidst Transit Limitations

Weight Restrictions and Their Operational Impact

Adhering to vessel weight limits is a critical aspect of managing ocean freight, particularly in light of the Panama Canal's restrictions. Due to reduced water levels in Gatun Lake, the canal authority has implemented a maximum draft limit, directly affecting the cargo capacity of container ships. This means that these ships must carry lighter loads to navigate through the canal.

For shippers, the implications are straightforward yet challenging: Lighter loads necessitate more frequent trips, leading to increased costs and complexities in scheduling.

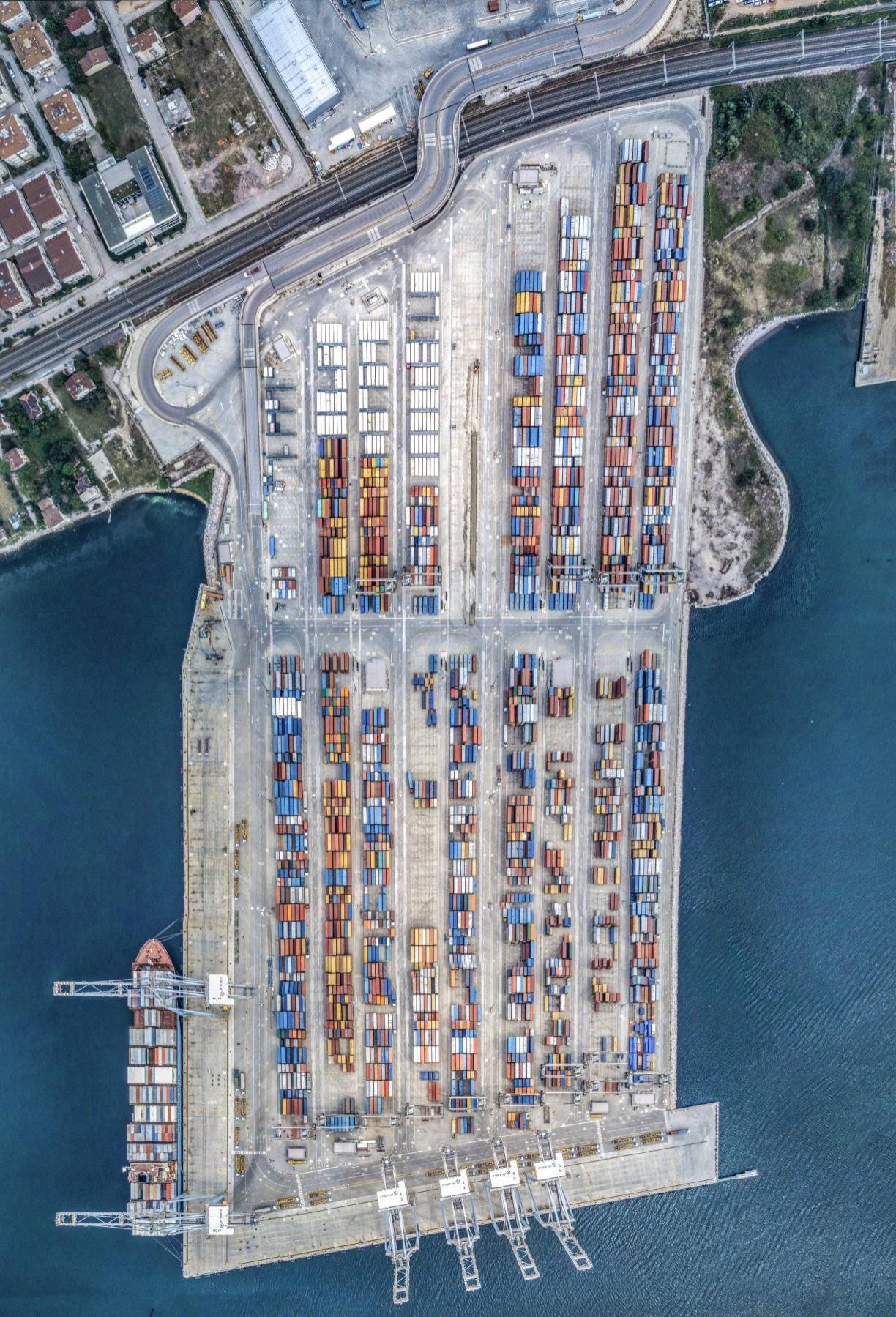

The ripple effect extends to ports as well. They are now tasked with accommodating not only the reduced payloads from vessels adhering to the new Panama Canal limits but also managing the cargo that cannot be shipped via this route. This creates a demanding situation for ports as they strive to efficiently handle and balance these logistics demands.

Anticipating Further Restrictions Coming Into Play

In an industry where change is the only constant, further restrictions and limitations are sure to spark more strategy shifts; shipping companies must plan A-to-Z routes with fingers crossed, hoping they won't have to pivot. Transparency and access to data on daily transits are vital for all stakeholders, as it is the only way to know when slots open up.

Final Thoughts

The impact of Panama Canal restrictions on global supply chains is not just a headline; it's a reality. Companies are pivoting, rerouting, and recalculating to keep up.

Remember this: transit times have stretched, and costs have climbed. The new norm for ocean freight operations will begin in the first quarter of 2024.

Think about alternatives like the Cape of Good Hope, alternative modes, or innovative solutions like SeaRates, and acknowledge that every extra day at sea means new planning and strategies—today's business challenge.

You should take away one crucial point: flexibility is key. Those who adapt their strategies will navigate these turbulent waters successfully.